Security threats, regulatory requirements, and risk management struggles—financial businesses deal with these challenges every day. Traditional methods often fall short, making it harder to identify risks, meet standards, and improve operations.

That’s where AI applications in finance come in. According to Markets and Markets, the AI in finance market was valued at USD 38.36 billion in 2024 and is expected to reach USD 190.33 billion by 2030, growing at a 30.6% CAGR.

These numbers show that AI is making a significant impact on financial services. From detecting suspicious transactions in real time to automating complex workflows, AI development services are helping businesses operate more efficiently and securely.

This blog will explore how AI is improving security, risk evaluation, customer engagement, and efficiency in the financial sector.

Why AI for finance?

- Boosts profitability: Lowers operational costs, improves efficiency, and creates new revenue opportunities through predictive analytics and automation.

- Competitive advantage: Leading banks, fintech startups, and investment firms already integrate AI to optimize services and gain market share.

- Smarter decisions: AI processes massive datasets to detect trends, assess risks, and refine financial strategies with high accuracy.

- Faster operations: Tasks like fraud detection, credit scoring, and compliance checks that once took days now happen in real time.

- Better risk management: AI models analyze creditworthiness, market fluctuations, and potential risks, helping financial institutions minimize losses.

- Improved security: AI-driven fraud detection systems identify suspicious activities instantly, reducing financial threats.

- Personalized customer experiences: AI tailors financial products and services based on user behavior, improving client satisfaction and engagement.

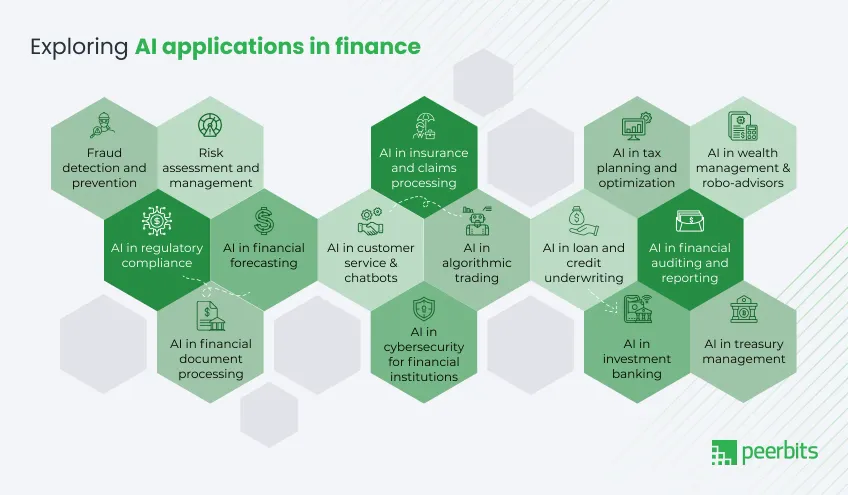

AI applications in finance

The financial sector is evolving rapidly, with AI transforming operations, security, and customer experiences. From fraud prevention to algorithmic trading, AI is optimizing processes that were once time-consuming and prone to human errors. Let’s explore some key applications of AI in finance.

1. Fraud detection and prevention

AI-driven fraud detection systems analyze massive transaction datasets to identify anomalies in real time. These systems use pattern recognition to detect suspicious activities, helping banks and financial institutions prevent unauthorized transactions before they occur.

Visa, for example, reported that it helped block $40 billion in fraudulent activity, nearly double from the previous year, using AI-driven security solutions. These systems continuously scan transactions, ensuring a balance between fraud prevention and a seamless customer experience.

2. Risk assessment and management

Financial businesses use AI to analyze large datasets, identify risks, and predict market fluctuations. It improves credit risk analysis, investment decisions, and financial forecasting.

Example: Bridgewater’s AIA Labs is developing an AI-based Reasoning Engine that uses proprietary techniques to conduct systematic investment research, helping hedge funds manage risks more effectively.

3. AI in financial forecasting

Predictive analytics powered by AI help financial firms anticipate stock market trends, forex movements, and cryptocurrency price fluctuations. These insights lets investors make informed decisions backed by real-time data.

For instance, JPMorgan Chase employs AI to forecast revenues and expenses, helping the bank improve financial planning and capital allocation.

4. AI in regulatory compliance

Regulatory compliance is complex and time-sensitive. AI automates anti-money laundering (AML) and Know Your Customer (KYC) processes, reducing compliance costs and improving accuracy.

Global banks like HSBC processes nearly 1.35 billion transactions every month across 40 million customer accounts to detect financial crime. AI helps the bank analyze vast datasets in real time, identifying suspicious activities faster and improving compliance with global financial regulations.

5. AI in customer service & chatbots

AI-powered chatbots provide 24/7 support, assisting customers with account queries, transactions, and loan applications. Voice AI further enhances user experience by processing natural language commands.

Bank of America’s Erica chatbot has handled over 2 billion interactions, streamlining customer support while reducing operational costs.

6. AI in algorithmic trading

AI-driven trading bots execute high-frequency trades by analyzing market data in real time. These bots make split-second trading decisions, maximizing profit opportunities.

For example, Renaissance Technologies relies on AI to manage hedge fund portfolios, consistently outperforming traditional trading methods.

7. AI in loan and credit underwriting

AI models assess credit risk by analyzing alternative data sources, such as spending habits and social behavior, enabling financial institutions to approve loans more accurately.

Microfinance companies like Tala use AI-based underwriting models to provide credit to underbanked populations, expanding financial inclusion.

8. AI in financial auditing and reporting

AI automates financial statement analysis, reducing human errors and improving audit efficiency. AI-powered tools can detect discrepancies and ensure compliance with financial regulations.

For example, PwC’s GL.ai uses AI to scan financial records and highlight irregularities, speeding up auditing processes.

9. AI in insurance and claims processing

AI streamlines claims processing by automatically assessing the legitimacy of claims, reducing manual intervention, and preventing fraudulent claims.

Companies like Lemonade use AI to process claims in minutes, significantly improving customer satisfaction.

10. AI in tax planning and optimization

AI analyzes financial records to optimize tax planning, ensuring businesses maximize deductions while complying with tax laws.

TurboTax integrates AI to assist users with personalized tax-saving strategies, simplifying tax filing for individuals and businesses.

11. AI in wealth management & robo-advisors

Robo-advisors use AI to create personalized investment portfolios, offering automated wealth management services without human intervention.

Wealthfront and Betterment leverage AI to rebalance portfolios, providing cost-effective investment solutions.

12. AI in cybersecurity for financial institutions

AI enhances cybersecurity by identifying and mitigating security threats, protecting sensitive financial data from cyberattacks.

Financial institutions like Wells Fargo use AI-driven security systems to detect phishing attempts and unauthorized access, safeguarding customer accounts.

13. AI in financial document processing

AI automates invoice processing and contract analysis, reducing paperwork and manual effort.

For instance, JPMorgan Chase’s COIN platform processes legal documents in seconds, saving thousands of hours of manual review.

14. AI for personalized banking & financial products

AI-driven recommendation engines analyze customer spending patterns to offer personalized financial products.

For example, American Express uses AI to suggest credit card offers tailored to individual users based on their spending behavior.

15. AI in investment banking

AI optimizes mergers and acquisitions (M&A) by analyzing market conditions and potential synergies.

Goldman Sachs employs AI to evaluate investment opportunities and streamline deal execution processes.

16. AI in payment processing and automation

AI reduces transaction failures and enhances payment security, ensuring seamless digital transactions.

Stripe uses AI to detect fraudulent payments and optimize payment success rates, improving e-commerce transactions.

17. AI in treasury management

AI improves liquidity management and cash flow forecasting, helping CFOs make data-driven financial decisions.

For example, Citi Treasury and Trade Solutions leverages AI to provide automated cash flow insights for corporate clients.

18. AI in financial sentiment analysis

AI analyzes news, social media, and financial reports to gauge market sentiment, enabling investors to predict market movements.

Bloomberg Terminal’s AI-driven sentiment analysis tools help traders assess the impact of global events on stock prices.

19. AI in hedge funds and asset management

AI automates portfolio rebalancing and risk mitigation strategies for hedge funds, optimizing asset allocation.

BlackRock’s AI-powered Aladdin platform manages trillions in assets by analyzing market risks and opportunities in real time.

20. Generative AI in finance

Generative AI is revolutionizing financial services by creating synthetic financial data, automating regulatory reports, and simulating economic scenarios.

For example, OpenAI’s GPT models generate financial summaries and assist in drafting regulatory compliance documents, reducing workload for financial analysts.

Read more: Machine Learning in finance: Trends and innovations

Challenges of AI adoption in finance

Data security & privacy risks

AI in finance processes vast amounts of sensitive financial data, increasing the risk of cyber threats and data breaches. Financial institutions must strengthen security measures.

Bias in AI models

AI models used in financial services can lead to biased credit scoring or investment decisions if trained on limited datasets. Ensuring diverse and accurate financial data is crucial.

High implementation costs

AI-powered financial solutions require significant investment in infrastructure and expertise. Many financial businesses struggle with the costs of AI adoption.

Explainability & transparency

AI-based financial decisions must be transparent for compliance and regulatory approval. Financial institutions must ensure AI models provide clear and accountable insights.

AI and human expertise: Balancing automation with oversight

AI is transforming financial operations, but human expertise remains irreplaceable. While AI can process vast amounts of data quickly, human judgment is crucial for decision-making, ethical considerations, and client relationships.

Financial businesses must strike the right balance between automation and oversight to maximize AI's potential while minimizing risks.

-

Automating repetitive tasks: AI takes care of tasks like transaction monitoring, fraud detection, and compliance checks, allowing financial professionals to focus on complex problem-solving and strategic planning.

-

AI in stock trading: AI-powered models analyze market trends, predict stock movements, and suggest trades in real time. However, human analysts evaluate geopolitical events, economic shifts, and company fundamentals before making final decisions.

-

Wealth management with AI: Robo-advisors create personalized investment portfolios based on AI-driven insights, but human advisors provide the emotional intelligence and financial coaching that clients need for long-term planning.

Finding the right balance ensures that AI enhances operational efficiency while financial institutions maintain accountability, trust, and a customer-centric approach.

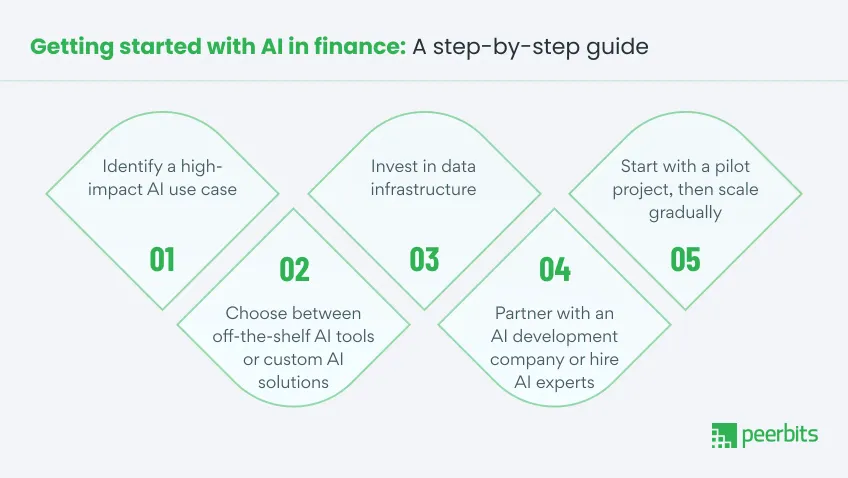

How businesses can get started with AI in finance

Businesses planning to use AI in finance need a structured approach. The right strategy helps in selecting suitable applications, setting up data infrastructure, and bringing in expertise. AI consulting services can assist financial firms in making the process smoother.

Step 1: Identify a high-impact AI use case

Start by selecting an area where AI can add the most value. Common applications include fraud detection, lending risk assessment, trading automation, customer service chatbots, and compliance monitoring. A well-defined use case ensures better results.

Step 2: Choose between off-the-shelf AI tools or custom AI solutions

Financial businesses can either use ready-made AI tools from cloud providers or build custom AI models for specific needs. Off-the-shelf solutions work for tasks like customer support automation and financial reporting, while custom AI can help with complex trading strategies, risk evaluation, and fraud detection.

Step 3: Invest in data infrastructure

AI requires accurate and well-structured financial data. Companies must set up secure data storage, real-time processing pipelines, and data management systems to support AI models effectively.

Step 4: Partner with an AI development company or hire AI experts

Building AI solutions needs the right skills. Companies can hire AI developers or work with an AI development company that specializes in finance app development. Experts help with model training, integration, and ensuring compliance with financial regulations.

Step 5: Start with a pilot project, then scale gradually

A small-scale AI project helps businesses assess its impact before expanding. Starting with a pilot in one area, monitoring the results, and making necessary adjustments ensures a smoother rollout when AI is applied across more financial operations.

Conclusion:

AI is already making a strong impact in finance. It is detecting fraud, improving risk analysis, and automating key financial processes. Businesses that use AI can reduce operational costs, process large datasets faster, and make more accurate financial decisions.

Integrating AI solutions requires careful planning. Financial institutions must focus on secure data handling, compliance with regulations, and the right mix of automation and human expertise. AI can speed up processes and uncover insights, but human oversight is still necessary for ethical and strategic decision-making.

The financial sector is becoming more competitive, and AI adoption is no longer just an option. Businesses that start now will be in a stronger position to improve efficiency, enhance security, and meet growing customer expectations.